About Us

Our industry-leading tax team delivers comprehensive tax services to support individuals, businesses, and organizations of all sizes.

About EthicsPro

At EthicsPro, we are an accounting and tax firm that specializes in core and advanced tax strategies. By leveraging over 22 years of experience in the industry, we save both small and large businesses thousands of dollars each year through tax planning and implementation. Our clients are able to take these tax savings and reinvest the funds back into their business. At the core, our primary objective is to help build the personal wealth of our clients.

On average, we save our clients $30K/year through key tax strategies. Our proprietary process will have us digging deep into your current financial landscape, applying advanced tax strategies, and then more importantly our tax approach is defendable and compliant.

A proactive stance to taxation lets your business comply with the law and take advantage of opportunities for tax savings and long-range planning that strengthens your competitive position. Get cutting-edge strategies and insights to inform business decisions, along with clear communication and hands-on involvement from our partners to build lasting relationships with your leadership team.

Meet Our Team

Senior Leadership

Tristen Eriksen

CEO / Partner

About Tristen

Tristen is a respected Financial Strategist and Partner. He understands that you want to create the business that is most important to you. He listens to your needs, vision and goals and works to achieve them. He is an advocate for winning your time back without sacrificing profit.

Reed Probst

COO / Partner

About Reed

Reed is a trusted Business and Tax Strategist. He is experienced in large corporation and small business management, operations and product management, technology development, marketing, investor relations, real estate management, and team development. He understands what you are facing and can assist you in accomplishing your goals.

Charlotte Bailey

Director of Operations

About Charlotte

Charlotte serves as Director of Operations and oversees Executive Administration at EthicsPro. In this role, she manages daily operations, team coordination, and executive support, ensuring that both internal processes and client-facing interactions run seamlessly. Holding a degree in Administration, she brings a strong foundation in organizational management along with extensive experience in operations, process improvement, and team leadership. Charlotte plays a key role in supporting EthicsPro’s continued growth by streamlining systems, enhancing communication, and aligning operations with the firm’s strategic goals.

Outside of work, Charlotte enjoys the quiet life in Southern Patagonia with her husband and two children, spending time hiking and exploring the natural beauty the area has to offer while maintaining a balance between family and professional life.

Jarem Eriksen

Tax Consultant

About Jarem

Jarem is a finance professional with a solid educational background. He holds a degree in Finance from Utah Valley University and has further honed his expertise with a degree in Finance, Business Administration, and Management, General from Brigham Young University – Idaho.

Currently serving as a Senior Tax Consultant at EthicsPro, Jarem specializes in delivering substantial tax savings through advanced tax strategies and proactive tax planning. His comprehensive approach not only saves clients money but also reduces tax liability, infusing additional cash into businesses. Jarem’s focus on growth strategies has proven resilient, standing the test of time even under IRS audit and scrutiny. With a wealth of knowledge and practical experience, Jarem is dedicated to helping businesses navigate the intricacies of taxation while optimizing financial outcomes.

Dave Tavres

Director of Program Management

About Dave

Sarah Isaacson

Tax Equity Strategist

About Sarah

Tax Teams

Sandra's Team

Sandra Mijangos

Tax Manager

About Sandra

Sandra is an experienced tax professional with over 12 years of expertise in tax compliance, planning, and advisory services. With a degree in Business Law she specializes in federal and multi-state tax strategy for individuals, corporations, and partnerships, including complex entity structures. Sandra partners closely with clients to develop tailored solutions that ensure compliance, reduce tax liability, and enhance financial efficiency. Her in-depth knowledge of evolving tax regulations and meticulous approach make her a trusted advisor in today’s complex tax environment.

Rachel McPeek

Senior Tax Associate

About Rachel

Rachel is a highly skilled accounting professional with a Bachelor’s degree in Business Administration, majoring in Accounting and Business, from the University of Dubuque. With a rich background spanning nine years in the accounting field, Rachel has cultivated expertise in diverse areas such as payroll management, bookkeeping, and the meticulous preparation of both corporate and individual tax returns.

Rachel’s unique blend of academic excellence and extensive hands-on experience positions her as a valuable asset in the accounting realm. Whether navigating intricate tax regulations or ensuring precise financial records, Rachel brings a wealth of knowledge and dedication to her role in the world of finance.

Kimberly Devoe

Tax Administrator

About Kimberley

Kimberly is a highly experienced accounting and operations professional with over 20 years of expertise supporting CPAs and tax teams. Her background includes tax return processing, detailed reconciliations, and workflow coordination – all contributing to a seamless, strategy-driven client experience. Known for her accuracy and reliability, Kimberly plays a vital role in maintaining client accounts & records, communications & scheduling, as well as supporting the execution of customized tax strategies. She leverages industry-standard tools to streamline internal processes and ensure timely, compliant outcomes. Her attention to detail and proactive support help drive efficiency and enhance the client experience at every stage of the tax strategy process. Outside of work, Kimberly loves reading, cooking for her family, and is a passionate music lover who enjoys discovering new artists and revisiting timeless classics.

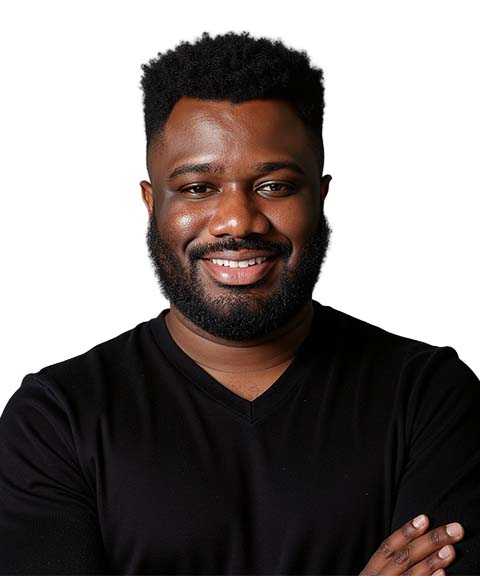

Ibrahima Keita

Tax Associate

About Ibrahima

Ibrahima’s journey in accounting showcases his unwavering dedication to precision and expertise. He earned a Bachelor of Science in Business Administration, majoring in Accounting and Finance, from the University of Montana Western. Furthering his education, he obtained a Master of Accounting from Western Governors University, solidifying his expertise.

Recognized as a leader, his passion for basketball and travel reflects his dynamic nature. Driven by his genuine passion and pursuit of excellence, Ibrahima Keita inspires others with his dedication and expertise.

Savannah Omier Rojas

Tax Associate

About Savannah

Savannah Omier Rojas is a highly skilled tax professional with a distinguished academic background and extensive experience in the field. She holds both a Bachelor’s degree in Accounting and a Master’s degree in Taxation from the University of Miami, where she cultivated a deep understanding of tax regulations and financial strategy. Savannah is dedicated to providing exceptional service and is passionate about staying current with the latest tax laws and regulations. She is committed to continuing to make contributions to the tax field and providing clients with the best experience possible.

Rhona Mabanta

Tax Specialist

About Rhona

Rhona holds a Philippine CPA license with experience in audit, general accounting, and tax advisory. She began her career at an audit firm, handling multiple clients across various industries. She then moved into corporate accounting at a major cement manufacturing company, where she managed general, revenue, and cost accounting.

With a strong foundation in financial reporting and compliance, Rhona is committed to helping businesses navigate complex tax and accounting matters.

Patrick's Team

Patrick Oliver

Tax Manager

About Patrick

Patrick is an accomplished tax professional with a wealth of experience and expertise in taxation. As a licensed IRS Enrolled Agent (EA) and holder of a Master of Science in Taxation (MST) from California State University, Patrick brings a comprehensive understanding of tax laws and regulations to his roles.

Patrick’s educational background includes a Bachelor of Science in Business with a focus on Finance from the University of Phoenix, Pasadena, demonstrating his commitment to excellence in the financial field. Dedicated to staying updated on the latest developments in taxation, Patrick is poised to continue making significant contributions to the field, ensuring clients receive the highest level of expertise and service.

Ben Schofield

Senior Tax Associate

About Ben

As a valued member of the firm, Ben brings a strong academic and professional background, holding a Bachelor’s degree in Accounting & Finance, a Master of Accounting with an emphasis in Taxation, and a Master of Business Administration. Currently, he is pursuing the Enrolled Agent (EA) credential to further enhance his ability to represent clients in matters related to taxation. Ben’s attention to detail and dedication to client service underpin the strategic financial counsel he will provide, helping clients navigate complex tax structures and achieve favorable outcomes.

Joanna Ashkar

Tax Associate

About Joanna

Joanna is a dedicated Tax Associate at EthicsPro with a solid foundation in business operations and financial strategy. She holds a degree in Business Management from Azusa Pacific University and brings a well-rounded background that includes experience as a Commercial Realtor and Office Manager, where she oversaw tax quality control and property management.

CTEC-certified and currently pursuing her Enrolled Agent designation, Joanna is a well-qualified professional known for improving operational efficiency and solving complex problems. Her strength lies in building strong, lasting relationships with clients, colleagues, and key stakeholders – always with a focus on helping clients meet their tax and financial goals.

Outside of work, Joanna enjoys spending time with her family, hiking, and reading.

Kimberly Devoe

Tax Administrator

About Kimberley

Angelie Lim

Tax Specialist

About Angelie

Jason's Team

Jason Opel

Tax Manager

About Jason

With over 8 years of experience as a CPA, Jason Opel specializes in tax strategy and compliance. A graduate of Oakland City University with a Bachelors of Science in Accounting and Management, Jason has worked with a wide spectrum of clients across various sectors. He focuses on deeply understanding his clients’ personal, professional, and long-term goals to provide tailored, strategic advice that empowers them in their financial planning and tax efficiency.

Jason is dedicated to building client relationships. He believes in educating his clients, helping them feel confident and informed about their financial decisions.

Charmaine Toussaint

Senior Tax Associate

About Charmaine

Charmaine’s professional career in public accounting initially focused on auditing and reviewing clients’ financials, which allowed her to gain a vast variety of experience in numerous businesses and financial reporting. It is there she cultivated strong client relationships, seeing all her clients as VIPs by providing unmatched client services. Charmaine is a Certified Public Accountant with a Bachelor of Business Administration degree, Accounting major from Baruch College of the City University of New York. Her passion for the tax code and her goal of providing her clients with the opportunity for growth through tax planning, refocused her career on tax compliance and strategies. She enjoys researching the tax laws, ultimately seeking to provide strategic tax planning to her clients that aligns with their business goals.

Tiffany Moore

Tax Associate

About Tiffany

With over five years of experience in tax, accounting, and client management, Tiffany currently serves as a Tax Associate at EthicsPro. She holds a Bachelor’s degree in accounting and finance and a Master’s degree in Accounting. Tiffany Moore excels in gathering and organizing tax information, ensuring efficient workpaper preparation, and handling general bookkeeping tasks using QuickBooks and QuickBooks Online. Tiffany Moore’s dedication to precision, relationship-building, and client satisfaction has contributed to their growth as a trusted professional in the industry. Tiffany is working towards her Enrolled Agent certification through the IRS in order to further her knowledge of taxation. In her free time she enjoys being outside and traveling.

Janet Howell

Tax Administrator

About Janet

With over 20 years of experience working alongside CPAs, Janet brings extensive knowledge and reliability to the fields of tax administration and office management. She has earned a reputation for accuracy, professionalism, and trustworthiness.

As a dedicated Tax Administrator, her responsibilities include managing and organizing tax documents, preparing and filings of tax forms to meet critical deadlines, and ensuring full compliance with regulatory standards. Known for her attention to detail, she handles confidential client information with discretion and care – ensuring every interaction is smooth, secure, and handled with integrity. Whether supporting the firm’s day-to-day operations or communicating directly with clients, she plays a key role in maintaining efficiency and building long-term client trust.

When she’s not in the office, Janet enjoys spending time outdoors, whether rollerblading along the Hollywood Beach Boardwalk or kayaking through South Florida’s scenic waterways.

Ping Tsai

Tax Specialist

About Ping

Ping is an experienced accounting professional from the Philippines, holding a double degree in Accounting and Management Accounting. With over seven years of expertise spanning banking, pharmaceuticals, and crypto industries, Ping supports the team remotely in tax preparation. He is committed to delivering accurate, timely, and detail-oriented reports that align with each client’s needs. Passionate about continuous learning, Ping actively explores tax strategies to help clients maximize their benefits while contributing effectively to team success.

James' Team

James Harvey

Tax Manager

About James

James is a licensed CPA who holds a Master’s in Professional Accountancy and a Bachelor’s in Business from East Texas State University. With over 15 years experience, he brings extensive knowledge in tax planning, compliance, and advisory services for both individuals and businesses. Over the course of his career, James has led a wide range of client engagements and supported team development through mentorship and training. Known for his detail-oriented approach, strong client relationships, commitment to continuous learning, and dedication to client success, he delivers clear, strategic guidance tailored to meet complex tax needs in an ever-changing regulatory environment. Outside of work, he enjoys spending time with his wife and 3 kids, staying active, and trying new restaurants.

Eric Mahon

Senior Tax Associate

About Eric

With a strong foundation in both audit and tax, and years of experience as a CPA, Eric brings a keen eye for detail and a passion for precision to every engagement. Eric holds a Master’s in Business Administration from Pace University’s Lubin School of Business where he developed a deep understanding of complex financial systems and regulatory frameworks.

Eric has worked with a diverse range of clients across different industries, offering both compliance services and strategic insights. His dual background in auditing and tax gives him a comprehensive perspective—whether analyzing internal controls, preparing returns, or helping businesses understand their financial health. He thrives on getting into the details, uncovering opportunities, and delivering clear, actionable guidance tailored to each client’s goals.

Outside the office, Eric is a devoted husband to a Commissioned Corps Officer in the U.S. Public Health Service, a dedicated hiker who’s always seeking the next trail, and an avid fan of fantasy literature. His love of the outdoors and storytelling reflects the same curiosity and commitment he brings to his professional life: always exploring, always learning.

Fei Han

Tax Associate

About Fei

Fei is a CPA with expertise in both individual and business taxation. She holds Bachelor’s and Master’s degrees in Accounting and is dedicated to delivering accurate, timely filings while helping clients clearly understand their tax returns. Committed to continuous learning, Fei stays up to date on evolving tax laws and sharpens her technical expertise to better serve clients. Known for her knowledge, integrity, and people-focused approach, she is a trusted advisor who takes pride in delivering high-quality results.

Janet Howell

Tax Administrator

About Janet

Jillianne Valencia

Tax Specialist

About Jillianne

Sarah's Team

Sarah Phillips

Tax Manager

About Sarah

Sarah is a seasoned CPA with more than a decade of experience helping individuals, corporations, and partnerships navigate complex tax matters. She specializes in strategic tax planning, compliance, and consulting across diverse industries, including agriculture, retail, professional services, and independent pharmacy. Sarah earned both her bachelor’s and master’s degrees in accounting from East Carolina University and is licensed in North Carolina. Recognized for her attention to detail and client-focused approach, she delivers clear, practical solutions that maximize tax efficiency. Outside of work, Sarah enjoys time with her husband and daughters, as well as beach days and boating with family and friends.

Joi Wimbush

Tax Associate

About Joi

Joi is a skilled tax professional with a growing experience in tax preparation and compliance for individuals and small businesses. She holds a Bachelor’s degree in Accounting from Georgia Southern University and is currently pursuing her Master of Accounting to deepen her technical expertise.

As a Tax Associate, Joi approaches each client engagement with thoughtfulness, precision, and a commitment to clear, compliant outcomes. She brings integrity, attention to detail, and a drive for continuous learning to her work.

Passionate about helping others navigate their financial responsibilities, Joi is steadily building a strong foundation in tax knowledge, technical skills and client service. She is committed to growing as a trusted accounting professional and consistently strives to deliver high-quality, service-focused support.

Janet Howell

Tax Administrator

About Janet

Mary Grace Reyes

Tax Specialist

About Mary Grace

Mary Grace is a seasoned Accounting and Tax Professional with over 20 years of experience helping businesses and individuals manage their finances with confidence and compliance. Based in the Philippines, she takes pride in delivering accurate, ethical, and personalized financial solutions that align with each client’s unique goals.

Mary Grace supports the team remotely in tax preparation, bringing her deep expertise and attention to detail to every engagement. Passionate about continuous learning, particularly in U.S. Tax, she embodies EthicsPro’s mission of integrity and excellence – helping clients achieve financial stability and long-term success while staying true to the firm’s core values.

Onboarding

Sarah Stuart

Senior Project Manager

About Sarah

Sarah is a highly skilled accounting professional with a strong foundation in financial strategy, critical thinking, and strategic planning. She holds a Master’s in Business Administration from the University of Utah and a Bachelor’s degree in Accounting from Weber State University. Prior to joining the team, Sarah gained a wealth of knowledge working for a large construction and real estate development firm, a ski resort, and a health consulting firm. Throughout her career, she has developed robust leadership and management capabilities, placing great emphasis on cultivating strong relationships with both clients and team members. Passionate and driven, Sarah thrives in fast-paced environments, tackling challenges with enthusiasm and a proactive mindset. Her journey is a testament to her commitment to financial excellence and her passion for fostering meaningful professional connections.

Amy Spencer

Tax Strategist / Onboarding Manager

About Amy

Carrie Colvin

Project Manager

About Carrie

With over 20 years of experience in office administration, customer relations, and process optimization, Carrie excels at streamlining operations and managing onboarding processes. She ensures a seamless experience for both clients and staff, while consistently promoting efficiency, teamwork, and a strong commitment to operational excellence. In her spare time, Carrie enjoys camping in the mountains with her family and embarking on adventures down scenic dirt roads.

Anna Valdez

Tax Specialist

About Anna

With over 18 years of experience in tax administration and accounting support, Anna has worked with individuals, small businesses, and high-net-worth clients. She specializes in organizing tax documents, ensuring compliance with deadlines, reconciling accounts, and supporting accurate tax return preparation. Known for her attention to detail and client-focused approach, Anna is dedicated to reducing stress and helping clients feel confident in their financial processes. Outside of work, she enjoys dog and house sitting, spending time with family, and collecting crystals during her travels.

Alicia Judd

Onboarding Specialist

About Alicia

Why Choose EthicsPro

Simply put, our goal is to help you minimize your tax liability. Our dedicated team of professionals are well-versed in tax law and work tirelessly to advocate for the needs of our clients.

We spend everyday working closely with our clients to solve a wide variety of tax issues, spanning a diverse set of industries. EthicsPro brings experienced knowledge and ample resources to any tax situation. It is our job to dig in and understand your business and your goals in order to build a customized approach to your tax plan.

Our tax and accounting teams have helped many businesses just like yours maximize their tax savings by interpreting evolving tax laws, providing consultation on business decisions and researching specific tax situations to determine the best course of action.

Using a personalized approach throughout the entire process, we work side-by-side with you to ensure you receive a strategic tax plan that yields maximum tax savings and fewer headaches.